This blog post provides a brief summary on the commencement of the Streamlined Energy and Carbon Reporting regime which has introduced mandatory corporate reporting obligations for relevant UK companies.

Introduced by the Companies (Directors’ Report) and Limited Liability Partnerships (Energy and Carbon Report) Regulations 2018, the SECR regime is a complex and comprehensive new corporate reporting regime that requires relevant UK organisations to report on their annual energy use, greenhouse gas emissions, energy efficiency measures and other associated information. While some companies that fall under the scope of the SECR regime may already report on emissions, a number of the reporting requirements will be completely new. It is therefore important that companies take the time to understand whether the SECR regime will apply and ensure the appropriate internal frameworks are in place for compliance.

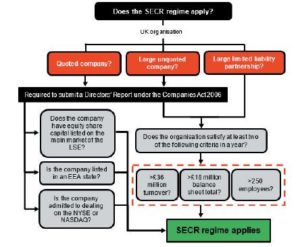

Who falls under the new reporting regime?

The mandatory reporting requirements under the SECR regime apply to UK ‘quoted companies’ (of any size), ‘large unquoted companies’ and ‘large limited liability partnerships’ (and may also apply to certain unregistered companies). This includes all organisations that may fall into these categories, including charitable and not-for profit groups.

Mandatory reporting requirements under the SECR regime

The mandatory reporting obligations under the SECR regime differ depending on the type of organisation. By way of example, new obligations introduced under the SECR regime will require each large unquoted company to report on:

- UK energy use and associated greenhouse gas emissions from activities for which it is responsible;

- UK energy use and associated greenhouse gas emissions from the purchase of electricity for its own use;

- any energy efficiency measures that were introduced or undertaken;

- the methodologies used to calculate the information it has reported;

- at least one ratio that explains its annual greenhouse gas emissions;

- energy use, greenhouse gas emissions reporting and any energy efficiency measures undertaken in the previous financial year; and

- whether the period for the energy use and the greenhouse gas emissions reporting is different from the period to which the Directors’ Report relates.

Quoted companies under the SECR regime will also be subject to some new reporting obligations, including, for example, reporting on global energy use and associated greenhouse gas emissions from activities for which they are responsible and relating to the purchase of electricity, heat, steam or cooling for their own use, while also disclosing what proportion of this relates to the UK.

Quoted companies and large unquoted companies must disclose the required information in their annual Directors’ Report, while large limited liability partnerships must provide a separate ‘Energy and Carbon Report’ to discharge their obligations under the SECR regime. There is no standard reporting template for the publication of this material.

Group reporting under the SECR regime may also apply to certain relevant organisations.

The SECR regime does not replace any existing environmental corporate reporting obligations to which companies may already be subject.

Do any exemptions apply?

Under the SECR regime, relevant companies may be exempt from having to comply with the mandatory reporting requirements where:

- the organisation is a ‘low energy user’ having consumed <40MWh during the relevant annual period;

- disclosure would be seriously prejudicial to the interests of the organisation, in the opinion of its directors or members; or

- it is not practical for the organisation to obtain the required information for reporting.

The principle of ‘comply or explain’ underpins the mandatory reporting requirements and the relevant exemptions.

Commencement of the SECR regime

The SECR regime commenced on 1 April 2019.

The first SECR regime-compliant report will be required for the reporting period 1 January 2020 to 31 December 2020 (for organisations that usually provide annual reports for the period 1 January to 31 December), or 1 April 2019 to 31 March 2020 (for those that usually provide annual reports for the period 1 April to 31 March).